Around the world, the income generated through taxes is crucial for a country to ensure that streets are built, hospitals and schools are run, and public services function properly.

ActionAid UK today has launched a campaign looking at how and where these taxes are paid – tax justice. In the report Calling Time: Why SABMiller should stop dodging taxes in Africa the organisation traces back how the world’s second-largest beer company SABMiller avoids paying taxes of up to £20 million in Africa.

Does businesses have a responsibility for society, and for the country and people where they operate? I believe they do.

So the question is: How to make sure that taxes are paid where they should be paid? A responsible approach to tax and engaging in a sustainable development strategy can certainly do a lot of good.

However, clear-cut transparency is better.

Let me highlight what this means for companies and governments.

As the report recommends, for businesses this means to:

be more transparent about financial information. Make public the accounts of each of its subsidiaries – especially for companies in countries where accounts are kept secret – and provide a country-by-country snapshot of tax payments and other financial information.

And for governments, this means to set the legal frameworks that

improve the transparency of corporate reporting, by making companies’ financial reports and beneficial ownership information accessible to the public, and creating a global country-by country financial reporting standard.

This request is actually not something so far away from reality as it may seem. Look at the US: Since this year, the Dodd-Frank financial reform bill requires oil, gas and mining companies listed on the New York Stock Exchange to mandatory disclose payments to foreign governments and the US (read more here and here). I am quite sure that we will see quite some exciting stories looking into this over the next couple of years.

Needless to say, that more transparency in financial reporting on both sides will be the best preventive measure for reducing corruption.

With this information in hand, the media and civil society can go ahead and do the maths.

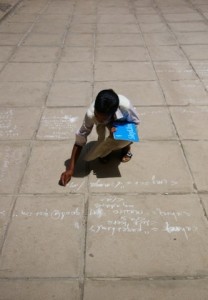

For example: What does drinking beer have to do with going to school? According to ActionAid’s calculations, the money that African countries lose each year could send an extra 250,000 children in school.

By the way, on more in-depth discussions on the issues of tax justice have a look at the blog by our colleagues at the Tax Justice Network, and of the Task Force for Financial Integrity and Economic Development. They are much more knowledgable than I am!

Photo credit: Ian Terney/UNDP IPC-IG: Humanizing Development

Connect with us on Facebook

Connect with us on Facebook Follow us on Twitter

Follow us on Twitter