Last week, the U.S. Department of Justice (DOJ) unveiled new guidance to federal prosecutors about bringing criminal cases against individuals in instances of corporate wrongdoing. The memo states that if a corporation wishes to resolve its own criminal charges and receive any credit for cooperation, it must provide the DOJ with all relevant facts relating […]

Corporate prosecutions: individual liability is essential

Corruption and banking: forex heralds an important change in rhetoric

This week’s announcement about the rigging of the foreign exchange markets marks one significant change: at last, the media and the Chancellor are using the word corruption to describe this behaviour. Today we take tough action to clean up corruption.” – UK’s Chancellor of the Exchequer George Osborne Since the financial crisis started in 2008, banks have been fined […]

Integrity Default Alert: EU probes collusion in banking sector

Reposted from the blog of Transparency International’s EU liaison office in Brussels. Corruption thrives in the dark, dank corners where no-one is looking, and banking is no exception. Who had heard of the LIBOR benchmark until the rate-rigging scandal erupted early last year? Now it is a byword for bad behaviour in banks. This week, […]

Fighting corruption in Italy is an uphill struggle

The current scandal of Monte dei Paschi di Siena (MPS), Italy’s third biggest bank, is a good illustration of how a lack of transparency negatively affects the fight against corruption in Italy. In general, ordinary citizens have little means to monitor and evaluate what goes on in either the public or private sectors. This is […]

New Report: Developing Countries Lost $5.86 Trillion from 2001-2010

Reposted from the blog of the Task Force for Financial Integrity & Economic Development. Task Force member Global Financial Integrity released their newest report on illicit financial flows from the developing world last night. The report found that $5.86 trillion left the developing world due to crime, corruption, and tax evasion from 2001-2010, $859 billion […]

Transparency comes calling on telecoms, banking sectors

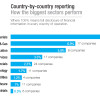

Our recent report on corporate transparency has exposed lamentably low levels of country-by-country reporting across the business spectrum. This means 69 of the world’s biggest companies operate in India, for example, but only two disclose how much money they made there, and not one discloses Indian tax payments on their main corporate website (see the […]

Financial Times joins chorus for more transparency at the ECB

We at TI-EU have been questioning the levels of transparency and accountability at the ECB, as you can see in our op-ed in the EU Observer and our blog post on President Barroso’s address . We are glad to see that those wise old heads at the Financial Times (motto: “without fear or favour”) came to the same conclusion. They, like […]

G20 must address financial integrity as corruption surges through major banking

Allegations of insider trading at Nomura, money laundering at HSBC, interest rate manipulation at Barclays – it’s one scandal after another! Some say mega-banks are too complex to manage and control, others blame bad management, still others say the culture is rotten. Corruption abounds. Greed, secrecy, arrogance, lack of a moral compass, and opportunity all […]

Licence to kill: banking experts discuss EU crisis management proposals

Commissioner responsible for the functioning of the EU’s internal market – has pledged to improve the representation of civil society groups in these meetingsto avoid the perceived stranglehold that the banking industry had on the European regulators in the run-up to 2008’s financial meltdown. On the evidence of the meeting I attended this week (Monday […]

- State Capture in South Africa 14 February 2017

-

What’s next for Ukraine?

16 December 2016

What’s next for Ukraine?

16 December 2016

-

Cleaning up sport: conflicts of interest at the top

9 December 2016

Cleaning up sport: conflicts of interest at the top

9 December 2016

-

OGP: France must do more to tackle corruption

9 December 2016

OGP: France must do more to tackle corruption

9 December 2016

-

Pharma companies in Slovakia: Uncovering conflicts of interest

9 December 2016

Pharma companies in Slovakia: Uncovering conflicts of interest

9 December 2016

-

Nokubonga Ndima: Young people can make a change for a better future...

-

Benjamin M: Very good article! Congrats!...

-

arun kottur: In India sports minister was involved decades are ...

-

Ekonomi: Very beneficial article. Thank you very much. htt...

-

ksweeney1: I do not agree that https://apex.aero/2016/09/22/g...

Search

Categories

Latest news from Transparency International

No items, feed is empty.

Connect with us on Facebook

Connect with us on Facebook Follow us on Twitter

Follow us on Twitter