The issue of whether or not to bail out the troubled banking sector in Cyprus has taken on serious political overtones as the crisis deepens. During the past few weeks Cyprus has been accused of failing to combat money laundering and fraud and that Russian oligarchs seek refuge for their money in this “tax haven” […]

Cyprus: a chance to strengthen its fight against money laundering

New Report: Developing Countries Lost $5.86 Trillion from 2001-2010

Reposted from the blog of the Task Force for Financial Integrity & Economic Development. Task Force member Global Financial Integrity released their newest report on illicit financial flows from the developing world last night. The report found that $5.86 trillion left the developing world due to crime, corruption, and tax evasion from 2001-2010, $859 billion […]

Is the G20 serious about fighting corruption?

In the past weeks we have witnessed a great deal of news surrounding issues of transparency and accountability of multinational companies. In the UK, several international corporations including Starbucks, Google, and Amazon, have been questioned in Parliament over the little corporation tax they pay despite their large UK accounts. Tax evasion is facilitated by the […]

Will billions in fines alone make banks respect the rules?

How banks implement international financial sanctions may not strike many as the sexiest news story of the day, but its importance comes alive when one remembers that holding a banking license and taking deposits from the public at large is not a right, but a privilege. It is bestowed on certain companies by the public […]

Can we restore integrity to the financial sector?

Integrity, trust and culture can seem like the most intangible and abstract of concepts in a hard-edged business environment – until they disappear. As the finance industry has discovered in recent years, failing to tend to a culture of integrity can cost you dearly. There are the record fines of course – such as those […]

Will Britain tackle tax evasion?

317 Pressure on what are alternatively called ‘offshore havens’, ‘tax havens305’ or ‘secrecy jurisdictions’ is reaching an unprecedented level. There are more than fifty such havens world wide, and governments are finally coming around to the idea voiced by activists that tougher regulation is needed. The economic crisis has lent urgency to the cause. Britain’s […]

Big banks: Where does the buck stop?

After four years of economic crisis and financial scandal, finally some good news. Eighty-five per cent of bank employees surveyed believe that their companies have an ethical duty to fight corruption. That is a finding from our survey of 3,000 businesspeople in 30 countries: Putting Corruption out of Business (see what businesspeople from other sectors […]

G20 must address financial integrity as corruption surges through major banking

Allegations of insider trading at Nomura, money laundering at HSBC, interest rate manipulation at Barclays – it’s one scandal after another! Some say mega-banks are too complex to manage and control, others blame bad management, still others say the culture is rotten. Corruption abounds. Greed, secrecy, arrogance, lack of a moral compass, and opportunity all […]

The financial sector: a culture of transparency?

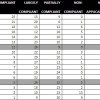

The recent global financial crisis highlighted the need to broaden the discussion about regulation and oversight of the financial system. Transparency and related risk assessments of financial institutions have surged to the top of the agenda. In our study on transparency and disclosure of measures for reducing corruption risk among the world’s largest companies published […]

Fail Again. Fail Better: Reform of the EU Banking Sector.

Samuel Beckett’s exhortation to “fail better” could also be applied to the EU banking sector. Time and time again, troubled financial institutions have been bailed out by the taxpayer because they have been perceived as “too important to fail”. The ability of a large number of banks to benefit from excessive risk-taking without fully absorbing […]

- State Capture in South Africa 14 February 2017

-

What’s next for Ukraine?

16 December 2016

What’s next for Ukraine?

16 December 2016

-

Cleaning up sport: conflicts of interest at the top

9 December 2016

Cleaning up sport: conflicts of interest at the top

9 December 2016

-

OGP: France must do more to tackle corruption

9 December 2016

OGP: France must do more to tackle corruption

9 December 2016

-

Pharma companies in Slovakia: Uncovering conflicts of interest

9 December 2016

Pharma companies in Slovakia: Uncovering conflicts of interest

9 December 2016

-

Nokubonga Ndima: Young people can make a change for a better future...

-

Benjamin M: Very good article! Congrats!...

-

arun kottur: In India sports minister was involved decades are ...

-

Ekonomi: Very beneficial article. Thank you very much. htt...

-

ksweeney1: I do not agree that https://apex.aero/2016/09/22/g...

Search

Categories

Latest news from Transparency International

No items, feed is empty.

Connect with us on Facebook

Connect with us on Facebook Follow us on Twitter

Follow us on Twitter